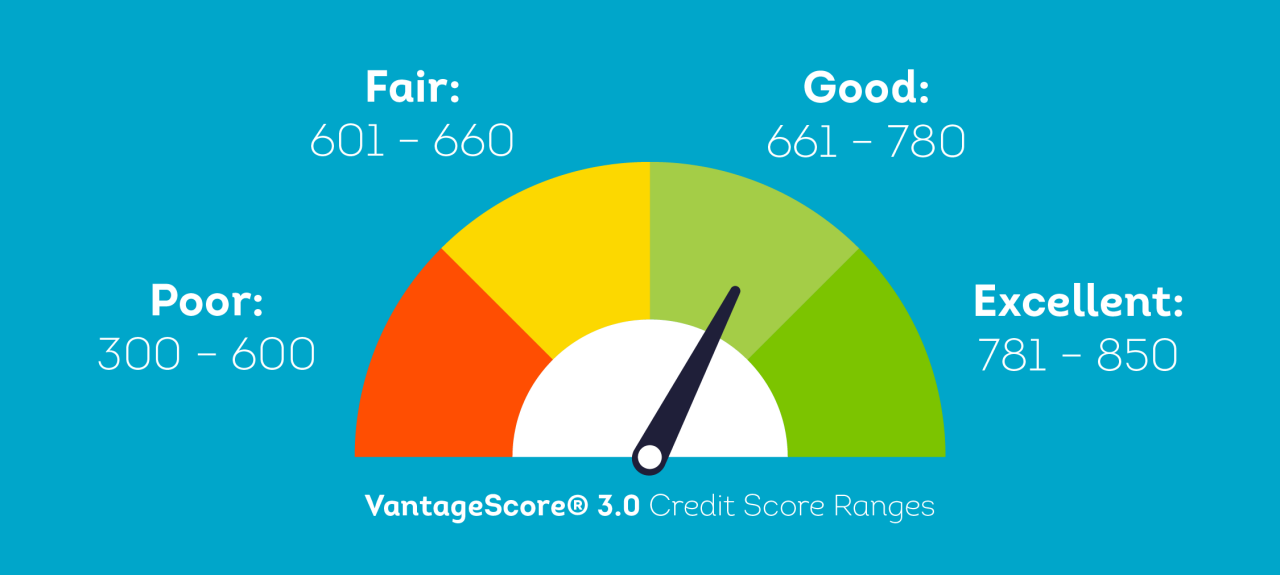

A credit score is a snapshot of the contents of your credit report. It is a three-digit number, generally between 300 and 850, that allows lenders evaluate your credit worthiness based on how you have managed debt and the repayment of credit in the past. This number often determines what you can borrow and on what terms (interest rates, repayment schedules, etc). This score allows lenders to evaluate credit applications in a faster, fairer and more consistent manner.

Payment History: How you pay your bills makes up the biggest portion of your

credit score. On time payment history is around 35% of your total score.

- Has the person paid his/her obligations on time?

- How often does the person pay late?

- How late is the person?

- How much has he/she been delinquent in the past?

Tip: Always pay traditional credit bills on time. If you cannot pay on time, try to pay them prior to 30 days late. There is nowhere for a creditor to note on your credit report that a payment was less than 30 days late.

Amounts Owed: Thirty percent of your score is based on how much you owe.

This is especially applicable to revolving account (credit card) balances.

- On all of a person’s credit sources, how much debt is he/she carrying?

- What is the person’s credit utilization rate? How much credit is he/she using in relation to the credit limit?

Tip: Don’t take out too much debt and keep your credit card balances below 30% of your limit.

Length of Credit History: This refers to how long you have had credit history and comprises 15% of your score. Three factors are used in evaluating your length of credit history.

- How long accounts have been open.

- How long specific account types have been open.

- How long it’s been since those accounts were used. (It’s generally a good idea to make sure you show some amount of activity on your revolving credit accounts).

New Credit: The opening of too many new accounts within a 12-month period

makes a borrower seem a higher risk and will typically have a short-term effect of lowering your credit score. The credit scoring companies have research findings to support borrowers who have recently taken on new debt are more likely to become delinquent or miss loan repayments.

- ● How many accounts have been opened in the past six to 12 months, as well as the proportion of accounts that are new, by account type?

- ● How many credit inquiries have been made recently?

- ● How long it’s been since the opening of any new accounts, by account type.

- ● How long it’s been since any credit inquiries.

- ● The re-appearance on a credit report of positive credit information for an account that had earlier payment problems.

Types of Credit Used: Your mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans will be considered in your FICO score. It is not necessary to have one of each, however you want to have both revolving and installment accounts on reporting to your credit report.

- How many credit or department store charge cards does the person have?

- How many auto loans?

- Does he/she have any mortgages or student loans?

- Can he/she manage multiple types of credit?

Improving the Credit Score

Based on the information used to calculate a credit score, what are five things a person can do to increase his/her credit score.

Items Not Included in Your Credit Score

- Race/Ethnicity

- Religion

- National origin

- Sex

- Marital Status

- Receipt of public assistance

What Does Your Credit Score Affect: Your credit score has the ability to affect multiple areas of your life? You credit score can affect:

- Interest rates on installment loans

- Interest rates on credit cards

- Your ability to rent a house or apartment

- Your ability to purchase a house

- Employment Premiums on insurance products